Aramco announces third quarter 2025 results

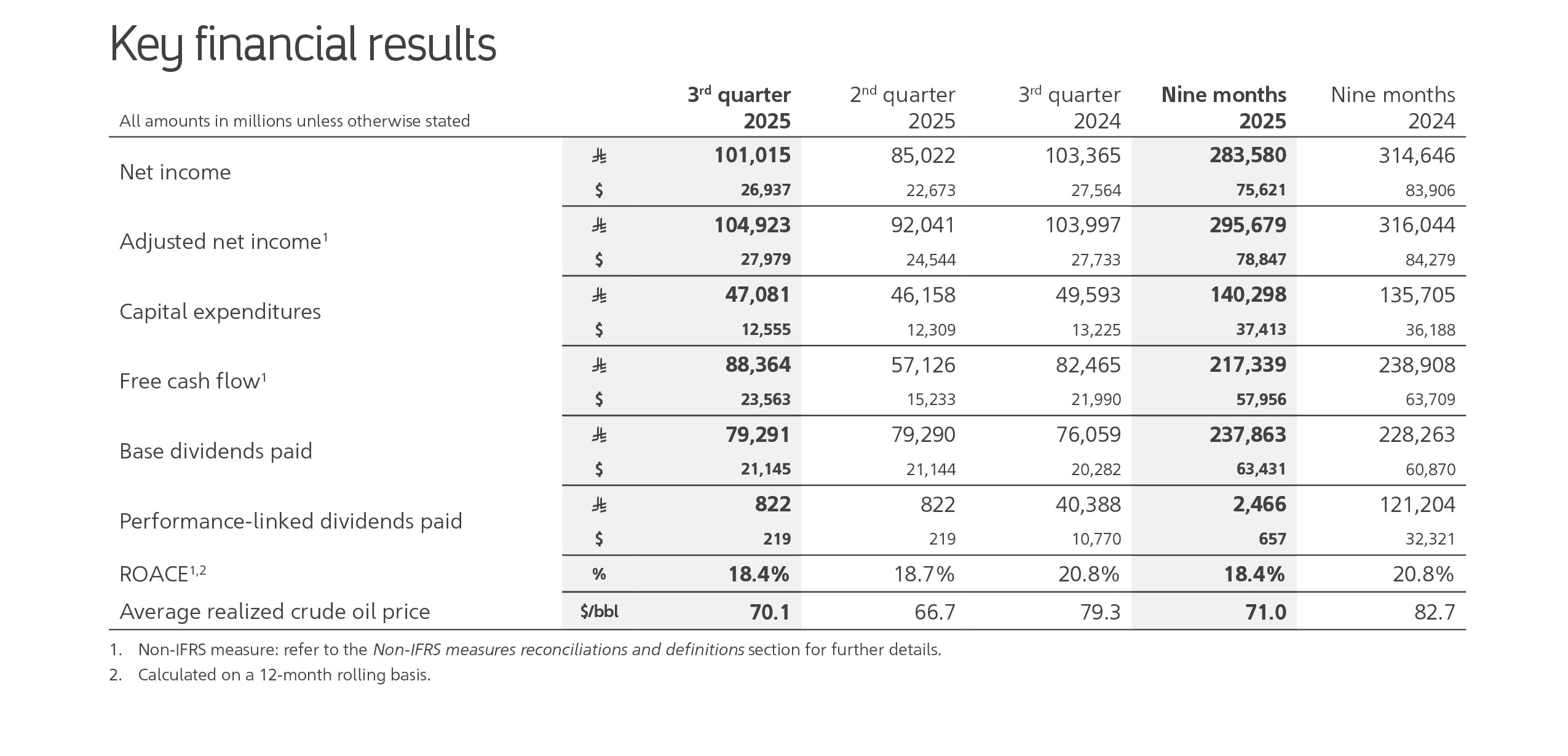

- Adjusted net income1: $28.0 billion (Q3 2024: $27.7 billion)

- Cash flow from operating activities: $36.1 billion (Q3 2024: $35.2 billion)

- Free cash flow1: $23.6 billion (Q3 2024: $22.0 billion)

- Gearing ratio1: 6.3% as at September 30, 2025, compared to 6.5% as at June 30, 2025

- Board declares Q3 2025 base dividend of $21.1 billion and performance-linked dividend of $0.2 billion, to be paid in the fourth quarter

- Announcement of planned investment in HUMAIN underscores digital strategy and unlocks new value creation potential

- 2030 sales gas production capacity growth target revised upwards, from more than 60% to around 80% over 2021 production levels, resulting in anticipated total gas and associated liquids of approximately six million barrels of oil equivalent per day

- Completion of $11.1 billion Jafurah midstream deal demonstrates attractive value proposition of Aramco’s unconventional gas expansion

- Initial investment and establishment of Fujian Sinopec Aramco Refining & Petrochemical Co. Ltd. reflects progress in strategic Downstream expansion

- Response to $3.0 billion international Sukuk issuance highlights investor confidence in Aramco’s financial resilience and robust balance sheet

Commenting on the results, Aramco President & CEO Amin H. Nasser said:

"Aramco’s ability to adapt to new market realities has once again been demonstrated by our strong third quarter performance. We increased production with minimal incremental cost, and reliably supplied the oil, gas and associated products our customers depend on, driving strong financial performance and quarterly earnings growth.

"We also continue to enhance our upstream capabilities, with major oil and gas projects either recently completed or due to come onstream soon. Today we announce higher sales gas forecasts, and we now target sales gas production capacity growth of approximately 80% between 2021 and 2030, capitalizing on advanced capabilities. Part of that is from our unconventional gas expansion at Jafurah, which attracted significant interest from global investors.

"Our strategy remains focused on value-accretive growth while meeting rising demand for energy, achieving even closer integration across our business, and leveraging advances in technology to unlock new commercial opportunities. Our deployment of advanced AI solutions and investment in digital infrastructure underpins this approach, and our plan to acquire a significant minority stake in HUMAIN is expected to further drive innovation and progress our role in the crucial and rapidly evolving AI sector."

For more information, please see the 2025 Aramco Third Quarter and Nine Months Interim Report.